The world of technology stocks has witnessed a remarkable surge in recent trading sessions, spurred by the Federal Reserve’s decision to cut interest rates for the first time since 2020. This unexpected move, aimed at stimulating economic activity, has catalyzed investor confidence, leading to a substantial rally in tech shares. As tech stocks take center stage, led by notable players like Tesla and Nvidia, it’s important to delve into the implications of these developments and their significance in the broader market context.

The Federal Reserve’s half-point reduction in its benchmark interest rate is a strategic maneuver that tends to favor technology companies. Lower borrowing costs naturally enhance the appeal of riskier investments, particularly in sectors like technology where growth is often tied to innovation and expansion. Following the announcement, the Nasdaq Composite surged by 2.5%, marking its most significant increase in 2024, largely driven by sharp gains in key tech stocks.

Tesla’s impressive 7.4% increase and Nvidia’s 4% rise exemplify how key players are thriving under these new conditions. These increases not only elevate the companies’ market positions but also reflect a broader trend where investors flock to technology stocks, perceiving them as more resilient amidst economic uncertainty. The rally on this particular Thursday moved the Nasdaq closer to its peak from earlier in July, illustrating a revived sense of optimism in tech equities.

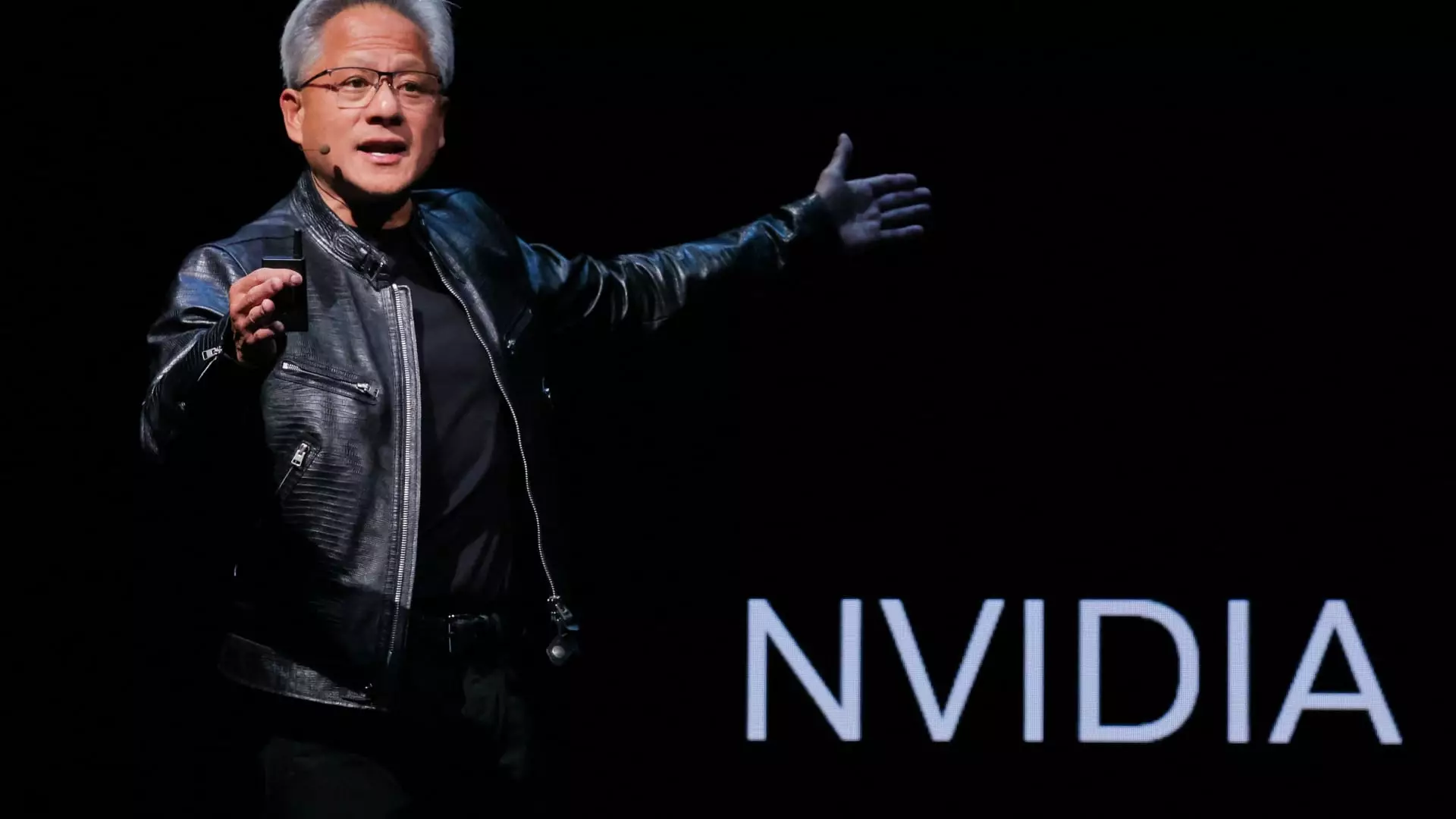

Nvidia stands out as a key driver of the recent tech rally. With a staggering year-to-date gain of about 138%, its rise is intricately linked to the booming interest in artificial intelligence. As the maker of advanced processors powering generative AI applications—from ChatGPT to advanced machine learning—Nvidia has positioned itself at the forefront of a technology wave that promises to redefine various industries.

Despite its recent gains, Nvidia operates in a niche market with a limited customer base. This concentration raises concerns about revenue volatility, particularly if demand from major clients like Microsoft and Google falters. However, the drop in interest rates potentiality alleviates some of this concern, providing a softer landing in the event of demand fluctuations. The current enthusiasm surrounding AI and its integration into everything from business operations to everyday life suggests that Nvidia could maintain its upward trajectory, despite the inherent risks associated with its customer concentration.

While Nvidia basks in the spotlight, competitors like Advanced Micro Devices (AMD) also strive to capitalize on the AI boom. AMD’s recent 5.7% rally reflects an ambitious push into the generative AI market, although the company finds itself lagging relative to Nvidia. The question remains whether AMD can establish a foothold in this competitive landscape. CEO Lisa Su’s remarks—emphasizing patience in the face of technological evolution—underscore the importance of long-term strategy over short-term gains.

Investors should recognize that the AI narrative is still unfolding. The landscape will likely witness significant shifts as additional companies attempt to stake their claim in AI, creating both opportunities and challenges for established players like AMD and Nvidia.

Tesla’s performance on the same day, where it rallied by 7.4%, is illustrative of its tumultuous journey in the tech sector. After a rocky beginning of the year, Tesla’s stock has rebounded significantly since an April low, resulting in a year-to-date uptick of 72%. The electric vehicle manufacturer’s recovery underscores the volatility impacting tech stocks, as well as the variable dynamics of investor sentiment towards high-risk ventures.

Despite Tesla’s growth trajectory, it still lags behind the broader tech market performance and has undergone considerable evaluation in light of its unprecedented valuation. As the market continues to adjust to changing economic conditions, Tesla’s ability to maintain investor confidence will be crucial in sustaining its momentum.

The recent interest rate cuts represent a pivotal moment for tech stocks, fostering an environment ripe for investment and innovation. As companies like Nvidia and Tesla thrive amidst this backdrop, the interconnectedness of interest rates, investor sentiment, and technological advancements—particularly in AI—will dictate the future trajectory of the tech sector. Investors must exercise diligence, remaining cognizant of both the opportunities and inherent risks, while navigating this ever-evolving landscape. The next chapters in this narrative are yet to unfold, but one thing is certain: the tech sector will remain a focal point of market attention.

Leave a Reply