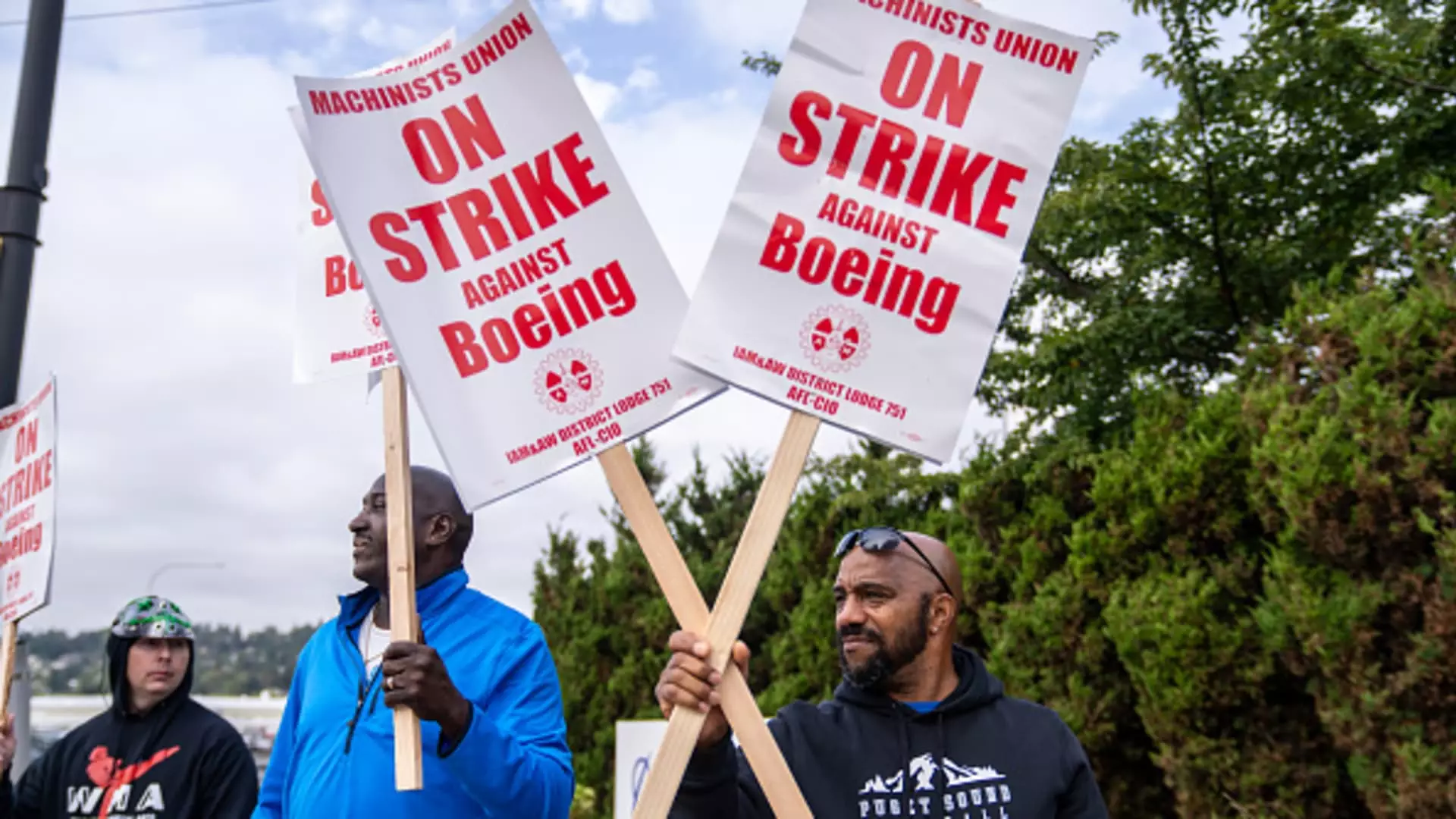

In September 2023, a substantial labor strike at Boeing emerged, marking a significant shift in labor relations for the company. More than 30,000 machinists from the International Association of Machinists and Aerospace Workers (IAMAW) walked off the job following a decisive rejection of a tentative contract proposal. This labor action has sent shockwaves throughout Boeing, resulting in escalating tensions, operational disruptions, and considerable financial implications, all while placing immense pressure on newly appointed CEO Kelly Ortberg to navigate a formidable path ahead.

The ramifications of the strike are extensive, with S&P Global Ratings estimating that Boeing incurs losses exceeding $1 billion each month. This staggering financial shock compounds an already tumultuous year for the aerospace giant, which began with a critical incident involving the 737 Max and was overshadowed by two tragic accidents six years prior. The ongoing strike has halted production at several factories across the Seattle region, deeply stunting Boeing’s cash flow and operational capabilities.

As the weeks progressed without resolution, it became evident that the company’s attempts to sweeten the deal were ineffective. Boeing’s leadership had expressed optimism concerning negotiations prior to the vote. However, these expectations were dashed when a striking 95% of the union’s members voted against the proposal. Analysts suggest that for Boeing to move forward, a more conciliatory approach must be adopted, impressing upon those in leadership the necessity of compromise in labor negotiations.

The impasse between Boeing management and union representatives is not merely a test of will but reflects deeper issues surrounding wage negotiations and benefits. Union leaders have reiterated their demands, particularly highlighting the desire for a return to a pension scheme, which could prove challenging given the current economic landscape. Professor Harry Katz from Cornell University has predicted that the strike may last several weeks longer, demonstrating that the end is not yet in sight.

Interestingly, Boeing has recently filed an unfair labor practice charge against the IAMAW, alleging bad faith in negotiations. Such actions strike at the heart of labor relations dynamics, shifting the narrative of the conflict from mutual negotiations to a legal quandary. Union President Jon Holden has since called for a renewed conversation, urging Ortberg to approach the situation with a fresh perspective, distancing himself from traditional methods that tend to intimidate rather than engage.

Despite the strike’s toll, the current job market in the Seattle area provides some relief for striking workers. Unlike during previous strikes, such as the one in 2008, a variety of contract work opportunities is available. Union members are accessing job postings for temporary gigs in food delivery services and warehouse operations, allowing them to mitigate some financial strain. However, this does not replace the need for stable employment offered by Boeing.

As the ramifications of the strike continue to reverberate, employees are now contending with lost paychecks and the absence of company-sponsored health insurance. These loss factors intensify the urgency for resolution as striking workers contemplate their future—a stark contrast to the expectations they once had of long-term employment with the aircraft manufacturer.

CEO Kelly Ortberg’s challenges extend far beyond resolving the current strike. The company recently reported a profound pre-earnings loss that indicated deeper systematic issues. Ortberg announced plans to eliminate approximately 10% of the workforce, consisting of layoffs that affect executives, managers, and operational staff alike while signaling long-term changes in Boeing’s business strategies.

Preliminary financial outlooks suggest that the bleeding of resources will continue, with analysts forecasting further instability if immediate action isn’t taken. The stock market response has also been alarming as Boeing shares plummeted 42% within the year, matching the highest declines seen in over a decade.

Given the current trajectory, Ortberg needs to restore investor confidence while navigating internal tumult and external market pressures. If the strike endures alongside continued production halts, it could entrench Boeing deeper into a crisis, adversely impacting its supply chain and relationships with stakeholders and clients.

The Boeing strike presents a complex intersection of labor relations, financial strain, and corporate management. The future of Boeing hinges on effective negotiation strategies, transparency in dealings, and a concerted effort to restore faith among both employees and investors. As the company stands at a crossroads, navigating this turbulent period will demand more than just task management; it requires innovative leadership to reintegrate worker satisfaction and operational efficiency while ensuring long-term stability for a historically significant manufacturer in the aerospace industry.

Leave a Reply