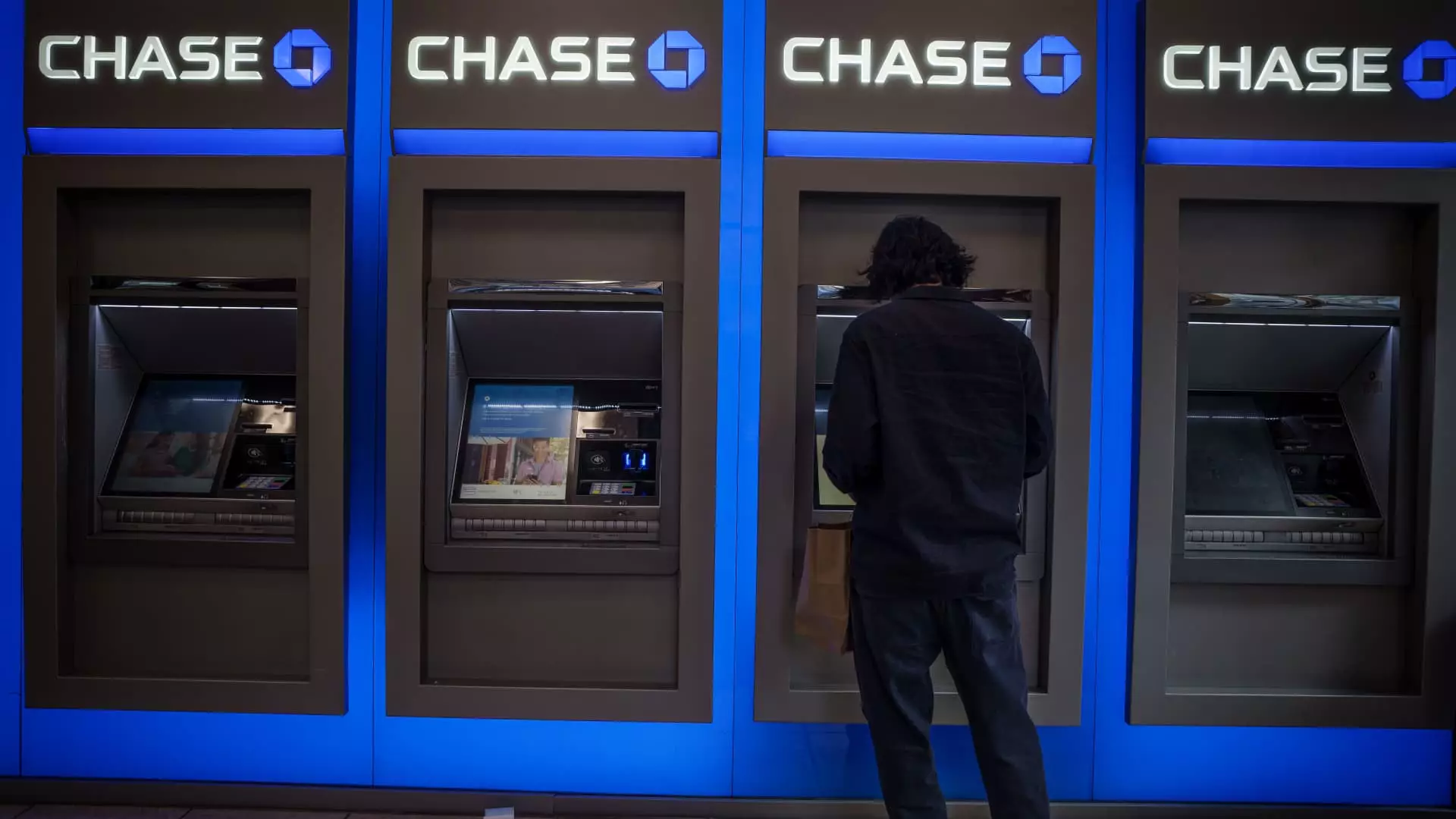

In a remarkable turn of events reminiscent of a modern-day Robin Hood scenario, thousands of unsuspecting individuals exploited a technical glitch in JPMorgan Chase’s ATM systems, managing to withdraw significant sums of money. This phenomenon, dubbed the “infinite money glitch,” gained traction on platforms like TikTok, sparking a frenzy among those eager to take advantage of what appeared to be a gift from the digital age. However, as this emerging trend unfolded, the consequences have become increasingly severe, illustrating both the vulnerabilities of traditional banking systems and the far-reaching impacts of social media.

The glitch allowed customers to withdraw funds almost instantaneously after depositing checks that later turned out to be counterfeit. As a result, individuals, often with accomplices, were able to extract much more than they deposited before the checks spontaneously bounced. As the situation escalated, JPMorgan Chase took decisive steps to curtail the situation by filing lawsuits against several individuals accused of conducting these fraudulent transactions.

On Monday, JPMorgan filed lawsuits in multiple federal courts, targeting those who allegedly withdrew the largest sums during this chaotic episode. One striking case is that of a Houston resident accused of racking up an astonishing $290,939.47 owed to the bank, stemming from a counterfeit check deposit of $335,000. The incidents showcase not only the vulnerability of financial institutions in the digital era but also the potential legal ramifications for those who dare to exploit such loopholes.

The bank’s swift move to pursue litigation reflects a broader strategy to discourage future instances of fraud and reclaim lost funds. Suspected fraudsters are not just facing lawsuits, but they are also at risk of further criminal investigations, revealing that banks are taking the phenomenon seriously and are determined to protect their assets and reputation.

Despite the growing prevalence of digital transactions, traditional paper checks remain a significant avenue for financial crime. In fact, according to a report from Nasdaq, fraud related to checks accounted for losses in excess of $26.6 billion globally last year. This unsettling reality exposes a pressing issue within the financial ecosystem; as digital payment methods continue to evolve, outdated practices still harbor vulnerabilities that can be exploited by those with ill intent.

The situation surrounding the infinite money glitch emphasizes an alarming trend: how social media can distort the perception of legitimacy surrounding fraudulent activities. Videos showcasing individuals flaunting wads of cash after gliding through the loophole led to a wave of imitations and an undercurrent of peer pressure among users, many of whom believed they could escape unscathed. The allure of instant wealth often blinds people to the risks and repercussions associated with such actions.

In light of this astonishing episode, the banking sector realizes that significant reforms are necessary to safeguard its systems from similar incidents in the future. After JPMorgan swiftly patched the loophole, it is imperative for financial institutions to continue evaluating existing policies surrounding check deposits and ATMs, especially as the digital landscape evolves. Implementing stricter regulations and innovative technological solutions can help maintain public trust in the banking system while minimizing the risk of fraudulence.

Moreover, as financial institutions navigate this unprecedented situation, clear communication with the public is essential. Banks must articulate the risks associated with exploiting such glitches and the potential ramifications of illegal activities. Transparency regarding their internal protocols and preventive measures will be crucial in restoring confidence among customers.

Ultimately, JPMorgan Chase’s response to the infinite money glitch serves as a critical reminder of the delicate balance between technological advancements and security. While the allure of easy money may captivate some, it is crucial for consumers to understand the intricacies of financial transactions and the potential consequences of their actions. As the bank continues to pursue legal avenues and collaborate with law enforcement, it is sending a strong message: fraud undermines the foundation of trust that the banking system is built upon, and those who partake in it will face dire repercussions.

The fallout from the infinite money glitch is far-reaching and multifaceted, offering a juxtaposition between the excitement of modern technology and the inherent responsibilities that accompany it. Banks must remain vigilant in an ever-evolving landscape, while consumers are tasked with navigating the complex realities of financial integrity.

Leave a Reply