The global semiconductor market is on an upward trajectory, bolstered by the recent announcement from Foxconn, officially known as Hon Hai Precision Industry. The Taiwanese electronics manufacturing giant disclosed a staggering fourth-quarter revenue of 2.1 trillion New Taiwan dollars, translating to approximately $63.9 billion. This figure is not only a significant 15% increase from the previous year’s fourth quarter but also marks the highest revenue recorded by the company in its history. Such impressive numbers illustrate not just the resilience of the semiconductor sector but also the catalytic effect that the burgeoning artificial intelligence (AI) market is having on technology companies around the world.

Foxconn’s remarkable performance is largely attributed to its diversified product segments, notably in cloud and networking services. These areas have seen robust growth partly due to the escalating demand for AI servers, especially those powered by industry leader Nvidia. However, it’s worth noting that while Foxconn thrived in this segment, other parts of its business, such as computing products and smart electronics—including smartphones—experienced slight declines. This variance underscores the selective nature of growth within the tech sector, where certain products are propelled by advancements in technologies like AI, while others face market headwinds.

A Broader Market Response

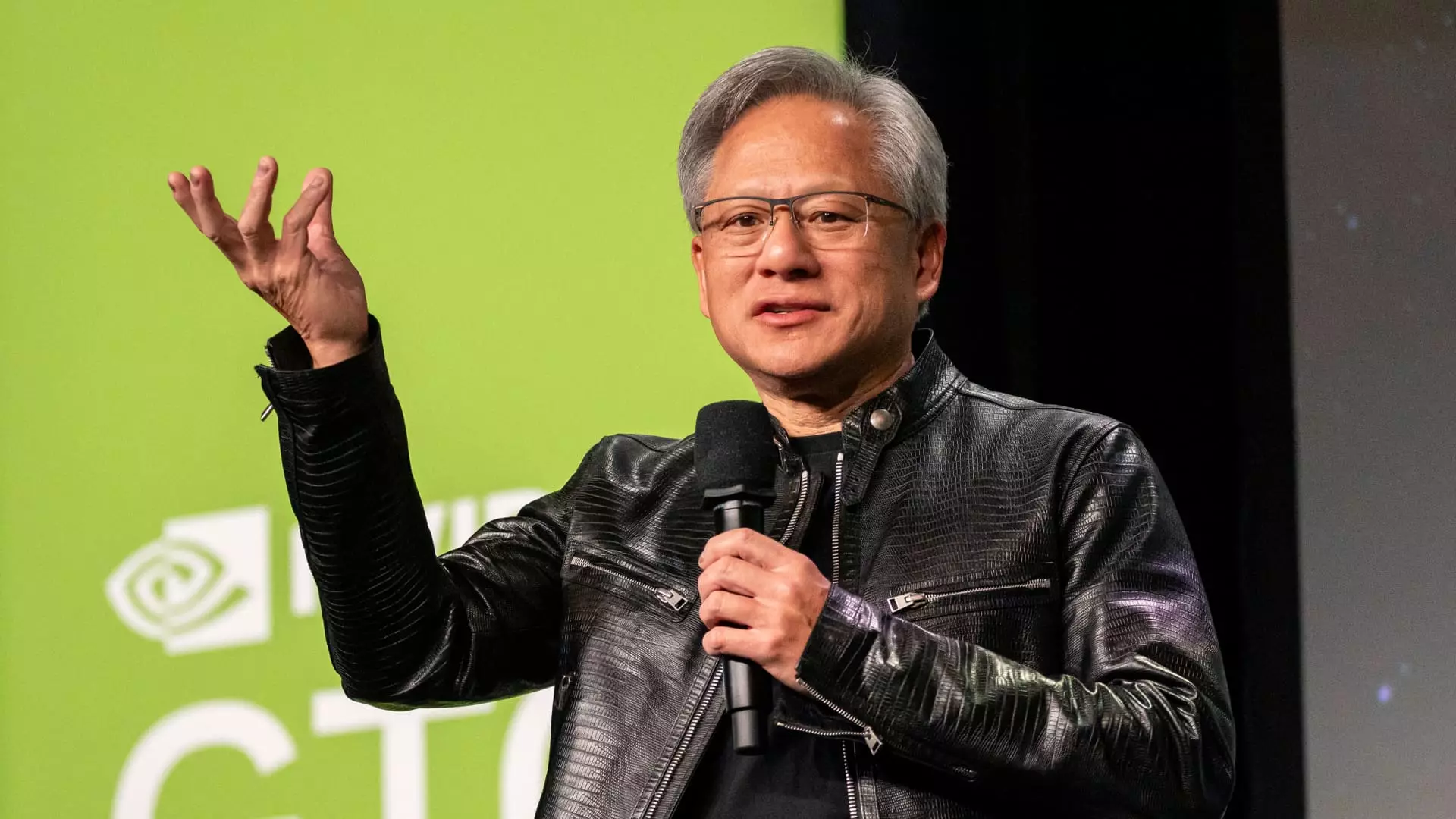

Unsurprisingly, Foxconn’s success resonated throughout the semiconductor market, triggering a substantial increase in stock prices for numerous companies across Asia, Europe, and North America. Notably, Nvidia experienced a considerable surge, closing up by more than 3%. This response reflects the interconnectedness of the semiconductor industry, where the fortunes of one major supplier can ripple through to affect others.

Additionally, Microsoft’s major investment announcement—an ambitious $80 billion plan for AI-capable data centers—further fueled this bullish sentiment among chip manufacturers. As the major tech players continue to pivot towards AI development, heavy investments in GPU technology from companies like Nvidia become increasingly vital. This trend is paralleled by AMD’s performance on the stock market, which also saw gains mirroring Nvidia’s rise, reinforcing the competitive landscape in which these companies operate.

In Asia, the semiconductor sector is experiencing its own renaissance. Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest chip manufacturer, hit record highs, gaining nearly 5% in its share value. TSMC produces an array of critical components for tech powerhouses such as AMD and Nvidia, thus its performance is indicative of broader industry health.

Moreover, other Asian firms such as SK Hynix and Samsung reported impressive gains, with share prices climbing nearly 10% and 4%, respectively. This trend reflects a robust recovery and the sustained demand for semiconductors in the face of escalating global digitization, emphasizing the technological world’s reliance on these components.

The European semiconductor landscape similarly exhibited bullish trends following the reports from Asia. Dutch company ASML, a critical supplier of semiconductor manufacturing equipment, saw its shares rise by 8.7%. Meanwhile, ASMI, another important player in the market, increased by 6.2%, indicating a healthy reception among investors. Notably, Germany’s Infineon and France’s STMicroelectronics also benefited, with their stocks shooting up nearly 7%. This collective rise encapsulates a broader recognition of the value and importance of semiconductor technology in driving modern innovations.

The surge in both stock prices and the optimism surrounding the semiconductor industry signals a promising outlook, particularly fueled by the AI boom. It is increasingly clear that companies that invest wisely in the renewal and expansion of their product lines will likely thrive in this environment. While challenges remain—especially for segments of the market experiencing declines—the overall trajectory suggests that we are merely witnessing the beginning of a new technological era.

As the global reliance on advanced AI solutions continues to grow, the semiconductor sector will remain core to enabling the innovations that define our digital future. The next quarters and years will reveal not only the sustainability of this upward momentum but also the evolving landscape as newer players enter the fray and existing companies adapt to meet the challenges and opportunities that lie ahead.

Leave a Reply