The landscape of medication coverage is rapidly evolving, particularly for drugs aimed at treating obesity and related health issues. Recently, a significant development regarding the coverage of Eli Lilly’s obesity drug, Zepbound, emerged following its approval for treating obstructive sleep apnea (OSA). This article delves into the implications of this coverage for patients, the regulatory framework governing such decisions, and the financial ramifications for taxpayers and health programs alike.

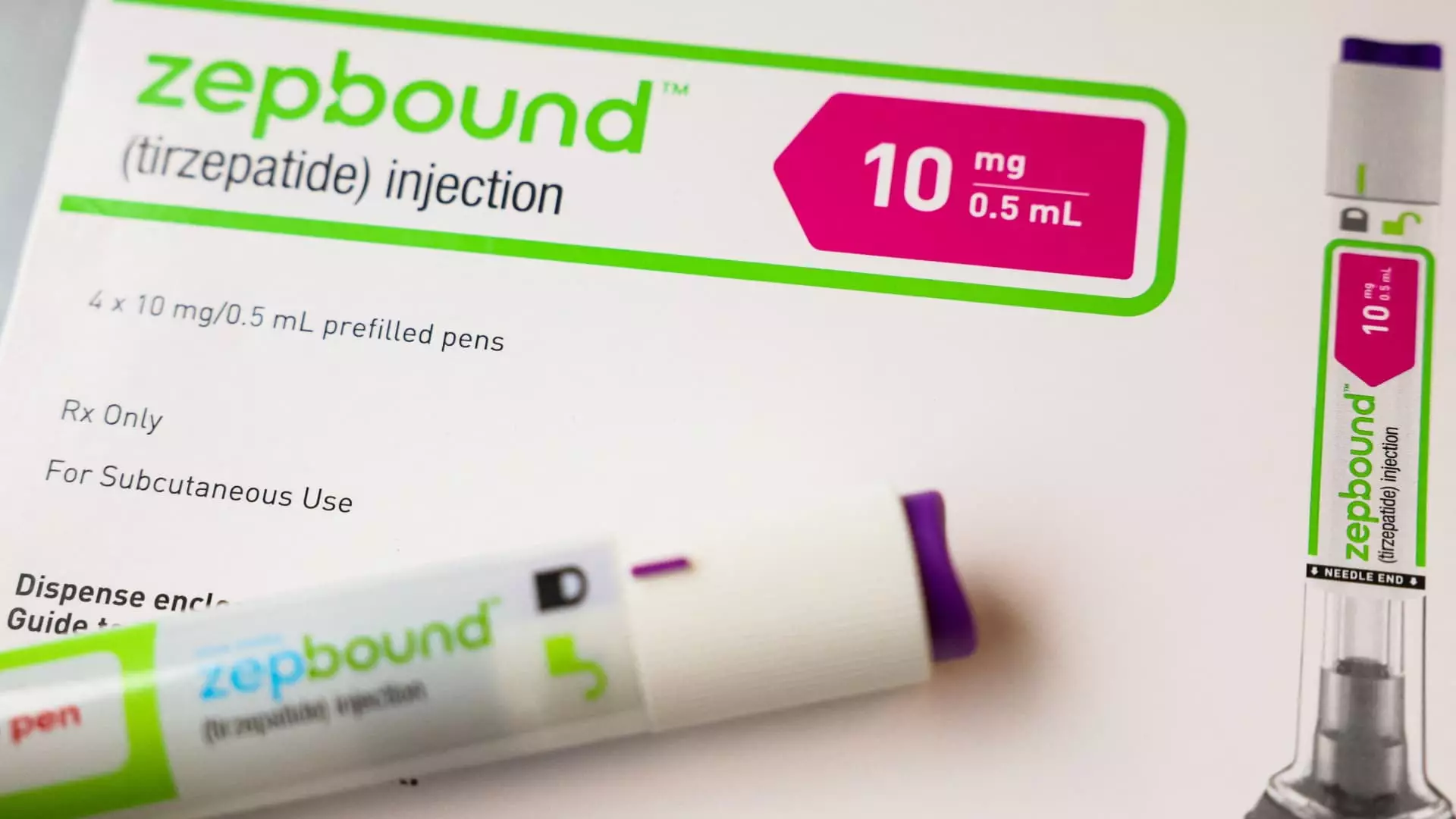

Zepbound has garnered attention as a groundbreaking treatment option for patients suffering from obesity and moderate-to-severe OSA, a disorder affecting millions. With the drug’s recent approval by the FDA, Zepbound has now become the first medication authorized specifically for this dual purpose. This critical distinction marks a notable shift in how obesity-related medications are perceived and covered under Medicare plans. Until now, many insurance plans, including Medicare, had been reluctant to cover weight loss drugs for indications other than obesity management alone.

The Centers for Medicare & Medicaid Services (CMS) clarified that Zepbound can be covered under Medicare Part D, contingent upon its use for conditions recognized by the FDA. This means that while the door for broader accessibility has opened, it is not without its caveats; Medicare recipients must have a demonstrable need for the drug related to OSA to qualify for coverage.

The existing framework for Medicare coverage compounds the complexity of accessing essential medications. Currently, Medicare Part D plans can address obesity treatments, but only if they fulfill an additional medical purpose. In Zepbound’s case, this is the management of obstructive sleep apnea, leading to potential coverage under the Medicare system. However, this method of access is fraught with limitations including prior authorization requirements, wherein healthcare providers must often navigate bureaucratic hurdles to secure necessary approvals before prescribing the medication.

In the same vein, Novo Nordisk’s similar weight loss drug, Wegovy, is similarly positioned within Medicare’s coverage guidelines, allowing it to be prescribed for cardiovascular risk reduction. The trajectory of both companies suggests a future where these blockbuster drugs could find additional applications under various medical conditions, expanding their use significantly—but only if adequate clinical trial results can demonstrate efficacy.

While the Medicare system has begun to adjust toward accommodating Zepbound and similar treatments, state Medicaid programs remain at the discretion of individual states and their agreements with drug manufacturers. This means that while Zepbound may be covered in some programs if prescribed for OSA, it may not be accessible for weight loss purposes in others, introducing a patchwork of coverage disparities that complicate patient access across different regions.

Each state’s Medicaid program operates with its own set of rules regarding drug coverage, emphasizing a need for streamlined regulations that could alleviate barriers to access. This inconsistency underscores the necessity for broader policy changes that would foster consistency across the United States, enabling equitable access for those who need it most.

The Biden Administration’s proposal to broaden Medicare and Medicaid coverage for obesity treatments poses potential benefits but also raises questions regarding fiscal responsibility. If the forthcoming rule is enacted, it could dramatically expand patient access to effective weight loss treatments, while concurrently posing an estimated cost of up to $35 billion over the next decade. The implications for taxpayers are profound, igniting a debate about the balance between providing necessary healthcare services and ensuring the economic sustainability of these programs.

As discussions regarding this policy continue, it remains to be seen what stance future administrations will take in relation to such high-cost healthcare measures.

The inclusion of Zepbound in Medicare drug plans represents a pivotal moment in the ongoing conversation about obesity management. By opening coverage channels for patients with related conditions such as obstructive sleep apnea, Medicare is moving towards a more inclusive model. However, the complexities of regulatory frameworks, state-specific Medicaid coverage options, and potential budgetary implications highlight that we are merely at the beginning of a long journey. Future developments will likely shape not only how obesity is treated in the United States but also set precedents for broader drug coverage initiatives.

Leave a Reply