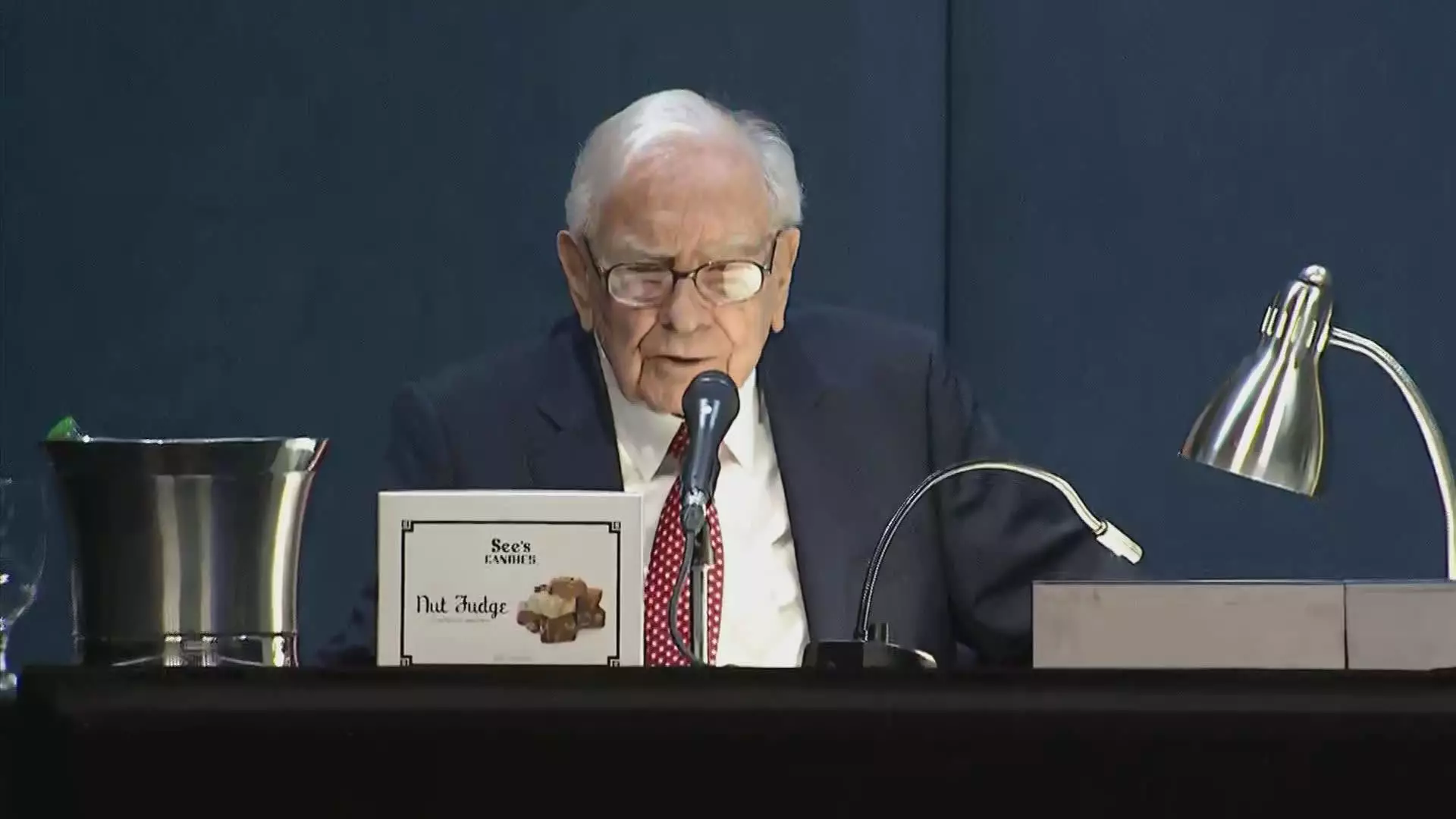

In times of extreme market volatility, every investor clutches on to a lifeline. Recently, that lifeline has been none other than Warren Buffett’s Berkshire Hathaway. During a week when investors were rocked by the news of aggressive tariffs imposed by former President Donald Trump’s administration, the conglomerate’s Class B shares experienced a less severe dip compared to the broader markets. While the S&P 500 and the tech-heavy NASDAQ Composite faced selloffs of 9.1% and 10% respectively, Berkshire Hathaway’s decline of only 6.2% was akin to finding an oasis in a desert of economic despair. This stark contrast underscores the resilience of a cash-rich company that harvests profitability from diverse sectors, including insurance and railways.

Buffett’s conglomerate represents what many investors increasingly desire: stability amid chaos. With approximately $334 billion in cash reserves, Berkshire Hathaway offers a financial fortress that stands strong against unpredictable economic currents. The company isn’t merely surviving; it’s thriving, holding its ground in a year where many stocks are spiraling downwards.

Defensive Stocks in a Turbulent Market

The allure of Berkshire Hathaway lies not just in its magnitude but also in its well-structured portfolio. Unlike many entities that are overly reliant on government policies or international agreements, Berkshire’s financial health is anchored in its extensive insurance empire and substantial investments in manufacturing, energy, and retail. In volatile times, defensive stocks like Berkshire become attractive. Investors searching for solace from market upheaval perceive Buffett’s company as an impregnable bastion, especially one that thrives on U.S. domestic economic activity.

Critics of the previous administration’s tariff strategies suggest that the ensuing trade war is stifling growth across multiple sectors. The tumult in the stock market demonstrates just how intertwined corporate fortunes can be with the decisions of policymakers. In this environment, Berkshire Hathaway appears to stand apart. As Josh Brown aptly pointed out, it embodies a certain independence that many companies lack. The market correctly recognizes that Berkshire Hathaway’s well-being is not contingent on the whims of any political agenda; it’s a business that models itself on consistent growth rather than erratic policy decisions.

A Unique Position Among Peers

In what can only be described as a breath of fresh air, Berkshire Hathaway is the only member of the S&P 500’s top 10 companies still trading above its 200-day moving average. This critical metric serves as a gauge for investor confidence and market momentum. For technical analysts, this is a significant endorsement of Berkshire Hathaway’s robustness. As Rich Ross elucidated, while this moving average isn’t the sole arbiter of a stock’s potential, its importance cannot be understated. The solitary position of Berkshire in this regard serves as a testament to its financial health and stability, particularly in an otherwise tumultuous market environment driven by external shocks.

The narrative is particularly inspiring at a time when numerous investors are reconsidering their portfolios, weighing the risks associated with more volatile stocks against the predictability offered by Berkshire Hathaway. In this context, Buffett’s company presents as not only a refuge but also as an opportunity for growth, as it is still up roughly 8% for the year.

The Investor’s Sentiment Shift

In this environment tinged with uncertainty and skepticism, it’s easy to see why a sentiment shift towards safety is occurring among investors. The current political landscape has introduced a level of unpredictability that even seasoned investors find daunting. In what seems to be a reflection of this uncertainty, many are leaning towards established, reliable entities like Berkshire Hathaway that have shown they can navigate through economic squalls unscathed.

As the market continues to process the broader implications of tariff wars and values hang in the balance, it remains to be seen whether this trend towards dependable stocks will persist. However, amid the commotion, one thing is clear: Berkshire Hathaway, under the enduring leadership of Warren Buffett, is far more than just another stock; it has become a symbol of stability, tenacity, and prudent investment in a world increasingly characterized by unpredictability. As such, it commands the interest of any investor wishing to shield themselves from the chaos that inevitably accompanies uncertain times.

Leave a Reply