In a moment that encapsulates both the promise and peril of the cryptocurrency world, Ilya Lichtenstein, a man at the center of one of the most notorious heists in digital currency history, has been sentenced to five years in prison. The 2016 hack of the cryptocurrency exchange Bitfinex saw the theft of nearly 120,000 Bitcoin, which was valued at about $70 million at the time but has surged in value to over $10.5 billion today. This case serves as a chilling reminder of the vulnerabilities within the cryptocurrency ecosystem and raises questions about the effectiveness of regulations governing this digital frontier.

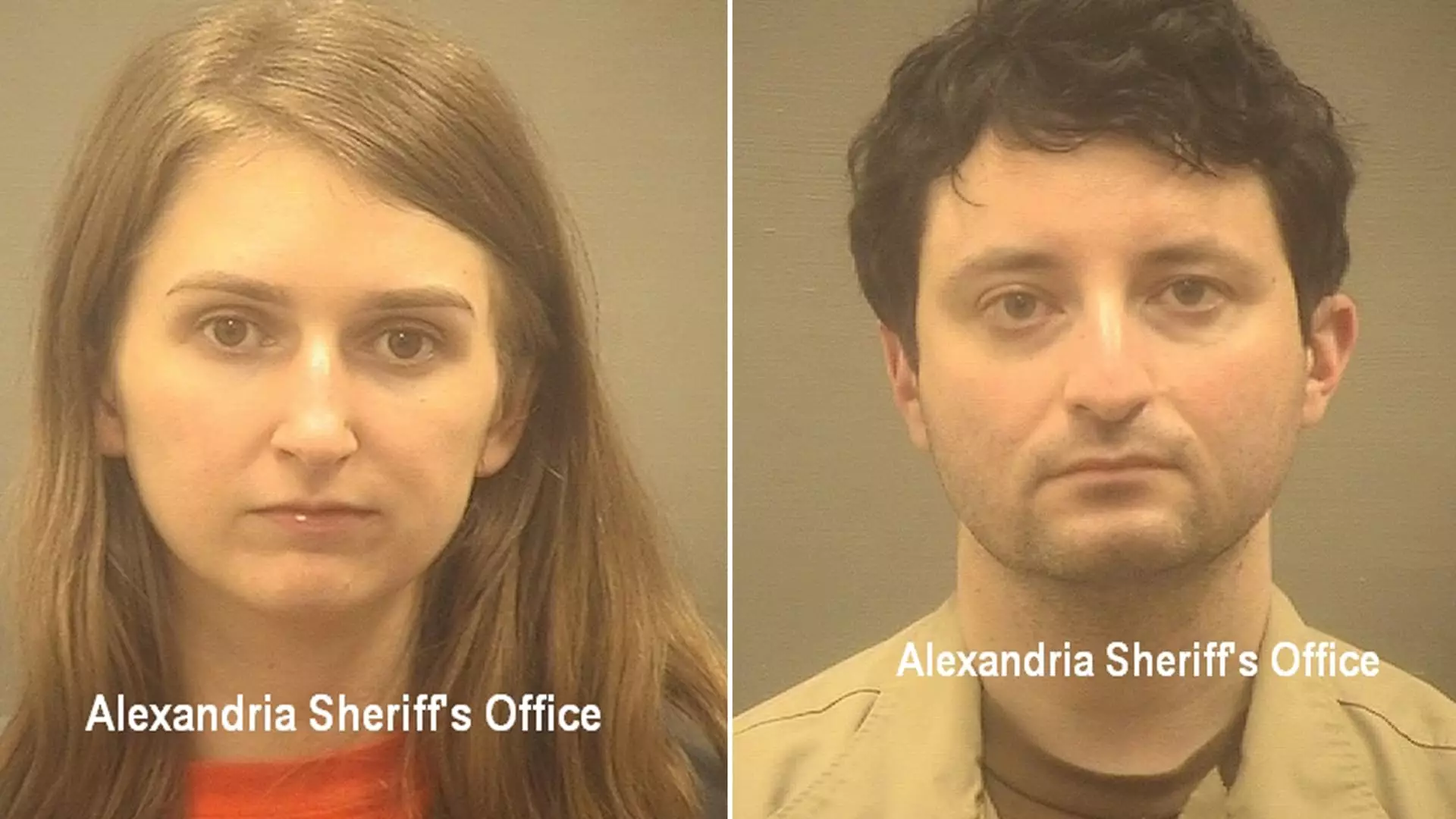

Lichtenstein, alongside his wife, Heather Rhiannon Morgan, orchestrated a sophisticated scheme to launder the stolen Bitcoin. This was not a simple act of theft; it involved intricate maneuvers and deceptive practices that caught the attention of federal authorities. The magnitude of deception involved was so elaborate that IRS agents remarked on its complexity, making it one of the most challenging cases they had encountered in the rapidly evolving landscape of cryptocurrency crimes.

At his sentencing, Lichtenstein expressed remorse for his actions, stating, “I want to take full responsibility for my actions and make amends any way I can.” His acknowledgment of guilt followed his August 2023 plea deal, in which he and Morgan admitted to their roles in the money laundering conspiracy—a significant shift from the era of denial that often typifies high-profile criminal cases.

The prosecution’s statement emphasized the severity of Lichtenstein’s actions, asserting that he had become “one of the greatest money launderers” faced by authorities in the cryptocurrency sector. At the same time, it reflects an evolving view of responsibility in the digital age. The lines between technology and morality blur, challenging our conventional notions of accountability in an era where cybercrimes can have monumental financial repercussions.

Facing a maximum sentence of 20 years, Lichtenstein’s eventual five-year term appears as both a considerable punishment and perhaps a lenient outcome given the scale of the crime. The U.S. District Court in Washington, D.C., has permitted him some degree of leniency by granting credit for the time he has already served during pre-trial detention. With the potential for early release based on good behavior, discussions around the adequacy of his punishment arise. Is a five-year sentence sufficient for such a massive financial crime, even with the complexity involved?

Notably, Lichtenstein’s sentence is matched against the backdrop of a broader movement in the justice system towards dealing with technology-related crimes. While authorities seem inclined to impose stricter penalties for severe violations, the legal framework surrounding digital assets and cyber offenses remains fraught with uncertainty. This case highlights not only individual culpability but also the need for a more comprehensive strategy to discourage and penalize cybercriminal behavior within the cryptocurrency market.

As authorities continue to unravel the case, a significant aspect remains regarding the fate of the assets involved. Prosecutors noted that over 94,000 Bitcoin have been seized from the illicit activities linked to Lichtenstein and Morgan, with the current value nearing $8.3 billion. There are discussions about restitution, with the government anticipating the return of these assets to Bitfinex or possibly other affected parties. However, the logistics of reclaiming lost cryptocurrency pose challenges.

The incident adds to a growing list of high-profile hacks and thefts that demand a reassessment of security measures and regulatory frameworks in the cryptocurrency space. As investors navigate these turbulent waters, the importance of understanding the risks associated with digital currencies has never been clearer.

The sentencing of Ilya Lichtenstein serves as a pivotal moment in the ongoing narrative surrounding cryptocurrency governance and criminality. As cryptocurrency gains mainstream acceptance, incidents like the Bitfinex hack expose critical vulnerabilities, highlighting the necessity for enhanced security protocols and robust regulatory oversight.

Ultimately, the case is a stark lesson in the responsibilities that accompany technological advancements. As we continue to embrace cryptocurrency’s potential, it becomes imperative that we safeguard against its misuse, holding accountable those who seek to exploit its limitless possibilities. Whether through effective law enforcement or improved security practices, the digital currency landscape must strive towards a safer, more resilient future.

Leave a Reply