In the fast-paced world of global finance, staying ahead of market trends is imperative for informed investing. Today, we explore critical elements shaping the trading landscape, particularly focusing on recent gains in major US indexes, significant workforce actions at Boeing, corporate earnings revelations from Adobe, groundbreaking medical advancements from Gilead Sciences, and corporate mergers impacting the fashion industry. This analysis aims to equip investors with the insights needed to navigate today’s trading environment effectively.

The latest trading day has brought encouraging news for investors as major indices experienced notable gains. The S&P 500 rose for the fourth consecutive day, posting a solid 0.75% increase. Even more impressive was the Nasdaq Composite, which climbed 1%, fueled primarily by a surge in technology stocks. Meanwhile, the Dow Jones Industrial Average added 235.06 points, translating to a 0.58% uptick. The timing of these gains is critical, coinciding with the release of the Producer Price Index (PPI), a key economic indicator that delivers insights into inflation. The PPI showed a modest 0.2% increase in wholesale prices for August, aligning with market expectations and providing a stable backdrop ahead of the upcoming Federal Reserve meeting.

In a situation that could significantly impact the aerospace sector, over 30,000 Boeing workers initiated a strike following the rejection of a proposed contract. The factory employees, represented by the International Association of Machinists and Aerospace Workers (IAM), voiced their discontent by ceasing work, which will directly affect the production of Boeing’s flagship models. IAM’s District 751 President described the strike as a response to what they termed “unfair labor practices.” This labor movement presents a pivotal moment for Boeing, which is grappling with a myriad of challenges. Boeing has publicly promised a renewed commitment to fostering a more productive relationship with both its employees and their union. The disruption to production raises questions about Boeing’s ability to meet demand amidst a recovering market while also navigating the recent operational pitfalls.

Tech giant Adobe reported quarterly results that exceeded Wall Street’s projections, marking a positive point for its stakeholders. However, despite the optimistic earnings report, shares dipped approximately 8% in premarket trading following a less-than-promising outlook for the fourth quarter. Analysts had anticipated an earnings per share (EPS) forecast of $4.67 along with projected revenues of $5.61 billion; instead, Adobe forecasted a narrower range for EPS and sales, leading to disappointment among investors. Notably, Adobe noted an encouraging 11% year-over-year growth in subscription revenue, highlighting its strength in recurring revenue streams. Nonetheless, the decline in stock value reflects the cautious sentiment among investors who are less inclined to overlook forward-looking uncertainty.

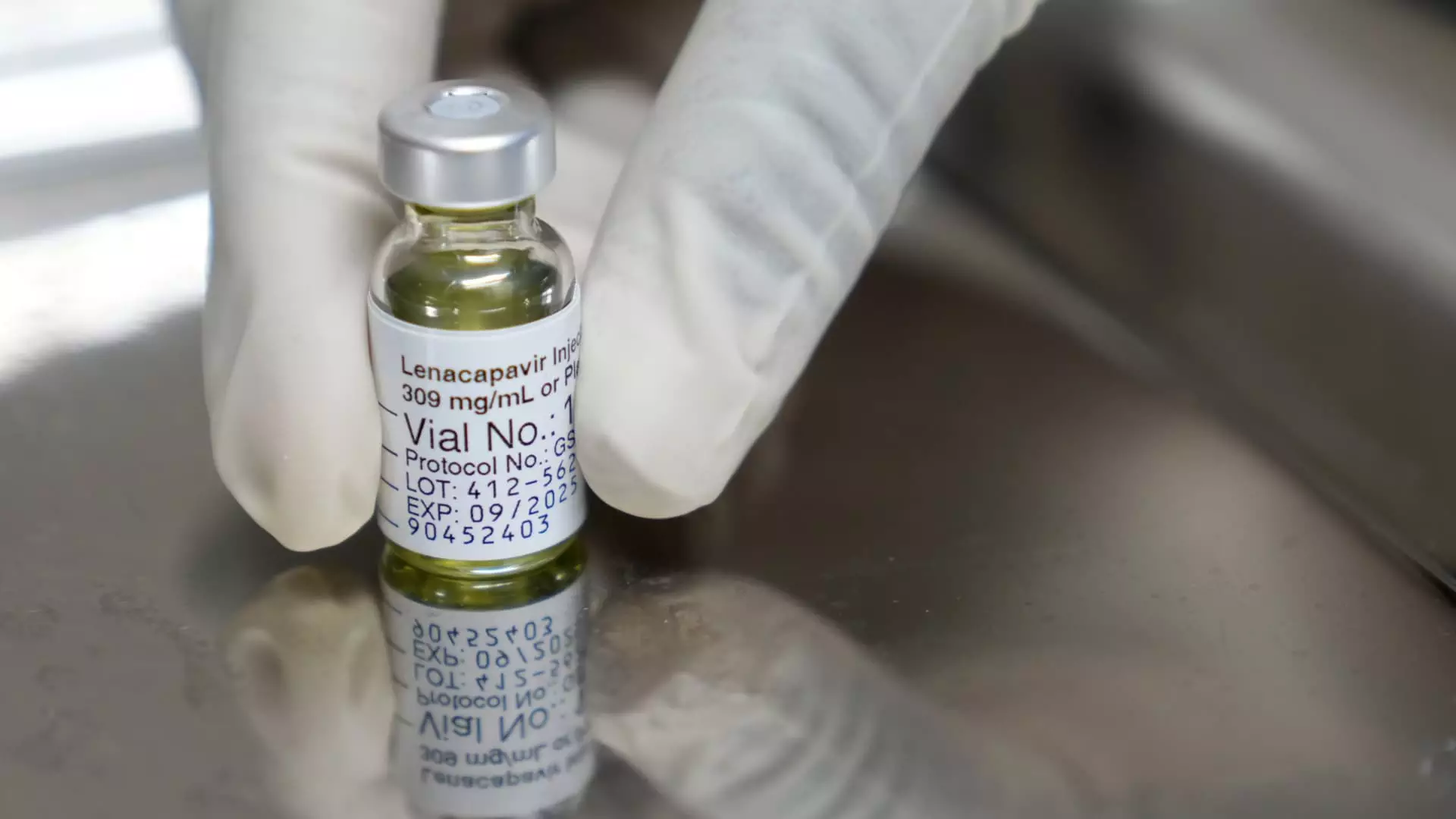

In a captivating development within the pharmaceutical sector, Gilead Sciences has unveiled promising data regarding its lenacapavir injection aimed at HIV prevention. A significant clinical trial showcased a remarkable 96% reduction in HIV infections among participants receiving the biannual injection. This groundbreaking result opens doors for potential FDA approval, marking a significant advancement in the fight against HIV. With only two instances of new infections among the 2,180 trial participants, Gilead’s data may pave the way for revolutionary treatment options, representing not only a compelling financial opportunity for investors but also a vital enhancement in public health capabilities.

In the realm of retail, two leading fashion firms are at the center of a pivotal merger discussion, enriching the narrative surrounding corporate consolidation within the industry. Tapestry, the owner of Coach, and Capri, the parent company of Michael Kors, are seeking to merge in an $8.5 billion deal that has faced scrutiny from the Federal Trade Commission (FTC). The FTC has raised concerns that this merger could stifle competition, elevate handbag prices, and potentially disadvantage employees in terms of compensation. The ongoing discussions reflect a broader conversation regarding industry dynamics and market health, signaling a critical point for potential investors to keep attention on competitive market forces and regulatory oversight.

Today’s financial landscape offers diverse narratives influencing investment decisions. From rising stock indices and labor disputes to corporate earnings reports and groundbreaking medical advancements, the interplay of these factors creates a complex yet intriguing environment for investors. Staying informed and vigilant will be paramount as the market continues to evolve.

Leave a Reply