Nvidia, once a proud member of the exclusive $3 trillion market capitalization club, has recently faced a significant downturn, relinquishing its spot and leaving only Apple standing. The company’s shares plummeted over 8% following their quarterly earnings report, resulting in a staggering loss of approximately $273 billion in market value. This decline reduced Nvidia’s market cap to $2.94 trillion, a stark reminder of the volatility that can beset even the industry giants. As the S&P 500 and Nasdaq also took hits, it underscored a broader market trend, urging investors to reevaluate their positions within the tech space.

As 2025 unfolds, Nvidia’s stock has seen a discouraging decline of 10%. This downturn coincides with a variety of investor apprehensions, including potential export controls and tariffs that could hinder the company’s growth trajectory. Compounding these worries are emerging, more efficient artificial intelligence models that may demand less computational power. Despite these setbacks, one cannot ignore the remarkable fact that Nvidia’s valuation has skyrocketed fivefold over the past two years, largely driven by the generative AI boom that began making waves in mid-2023. Its momentous rise to a $3 trillion valuation in June 2024 feels like a distant memory in light of recent events.

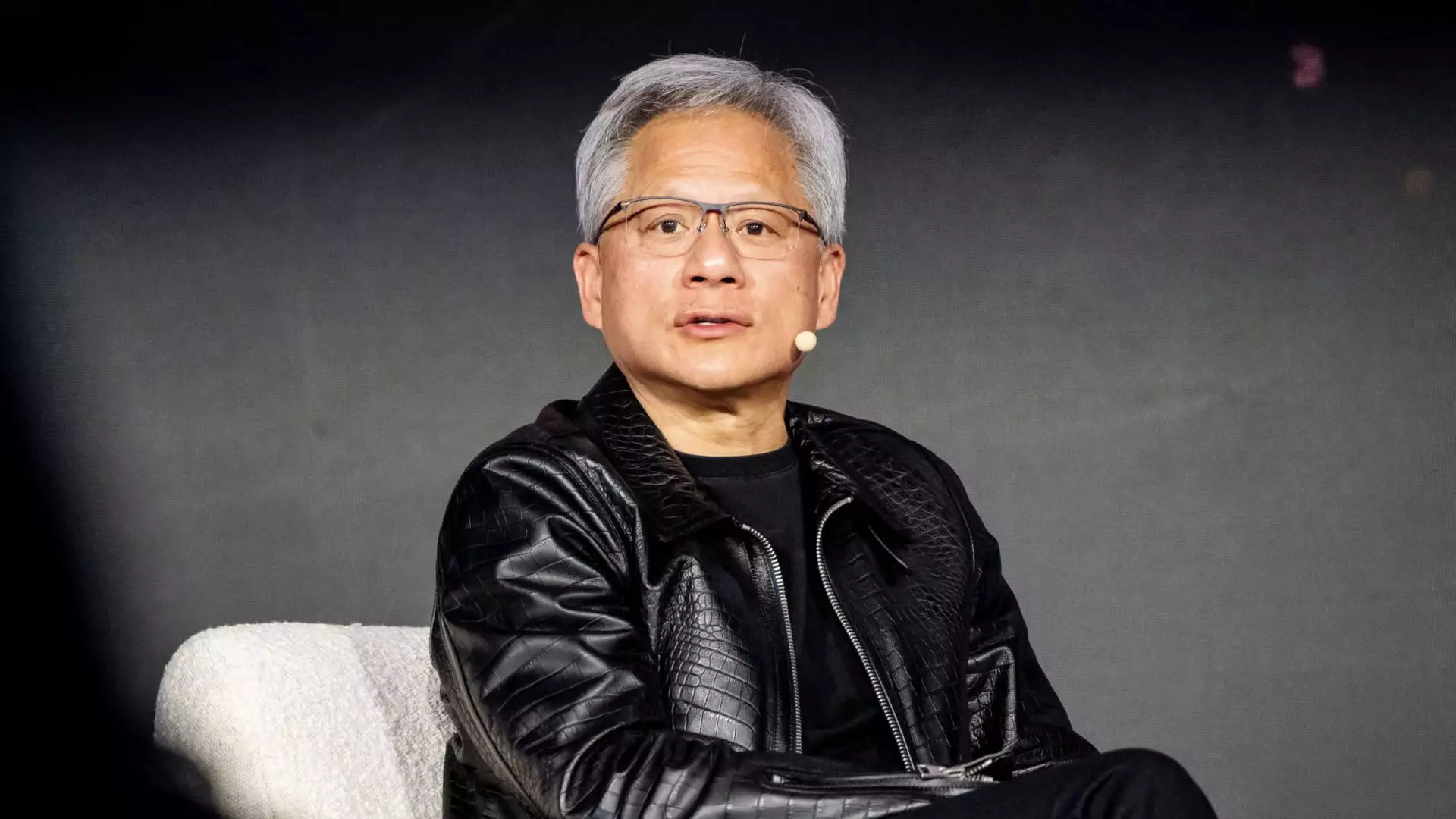

Nvidia’s latest earnings report revealed that the company outperformed analysts’ expectations, boasting a 78% increase in revenue year-over-year, reaching $39.33 billion. This figure includes a remarkable 93% surge in data center revenue, primarily fueled by its leading graphics processors, essential for AI workloads. While the report initially sparked enthusiasm, this was quickly dampened by broader market conditions and the cautionary notes that followed. Nvidia’s CEO, Jensen Huang, offered insights predicting a strong start to fiscal 2026, alleviating fears of production issues concerning its next-generation chip, Blackwell. Still, the market’s reaction illustrates a fundamental concern: can Nvidia sustain its explosive growth amidst a shifting technological landscape?

Huang’s assertion regarding the increasing demand for advanced computing power indicates a long-term optimism about AI capabilities. He highlighted that the computational demands of next-gen AI models could be up to 100 times more than previous iterations. Despite these promising forecasts, the mixed signals from the market reflect a growing skepticism among investors. Large cloud service providers, such as Microsoft, Google, and Amazon, which comprise about half of Nvidia’s data center revenue, present both opportunities and threats. Their evolving partnerships could either fortify Nvidia’s revenue streams or expose it to the risks associated with changing tech landscapes and competitive pressures.

Nvidia stands at a critical juncture, navigating the complexities of the evolving tech industry. While its achievements in revenue growth and technological advancements cannot be dismissed, the challenges it faces should not be ignored. As the market continues to fluctuate and investor confidence wavers, Nvidia must devise strategies not only to recover its previous valuation but also to inspire renewed faith among stakeholders. The path forward may be fraught with challenges, but Nvidia’s ability to innovate will be crucial in securing its place as a formidable player in the tech arena for years to come.

Leave a Reply