Philadelphia Federal Reserve President Patrick Harker has provided a strong endorsement for an interest rate cut in September. Speaking at the Fed’s annual retreat in Jackson Hole, Harker expressed confidence in the need for monetary policy easing. He emphasized the importance of starting the process of moving rates down in September and advocated for a methodical approach to signaling rate cuts in advance.

Market expectations currently indicate a 100% certainty of a quarter percentage point cut, with a 1-in-4 chance of a 50 basis point reduction. However, Harker remains undecided on the magnitude of the cut, stating that he needs to see additional data before making a final decision. Despite this uncertainty, the Fed is poised to take action in response to inflation concerns and labor market weaknesses.

Harker stressed the independence of monetary policy-making from political concerns, especially as the presidential election looms in the background. As a proud technocrat, Harker emphasized the importance of data-driven decision-making and responding appropriately to economic indicators. The Fed’s focus on data rather than politics underscores its commitment to maintaining economic stability and growth.

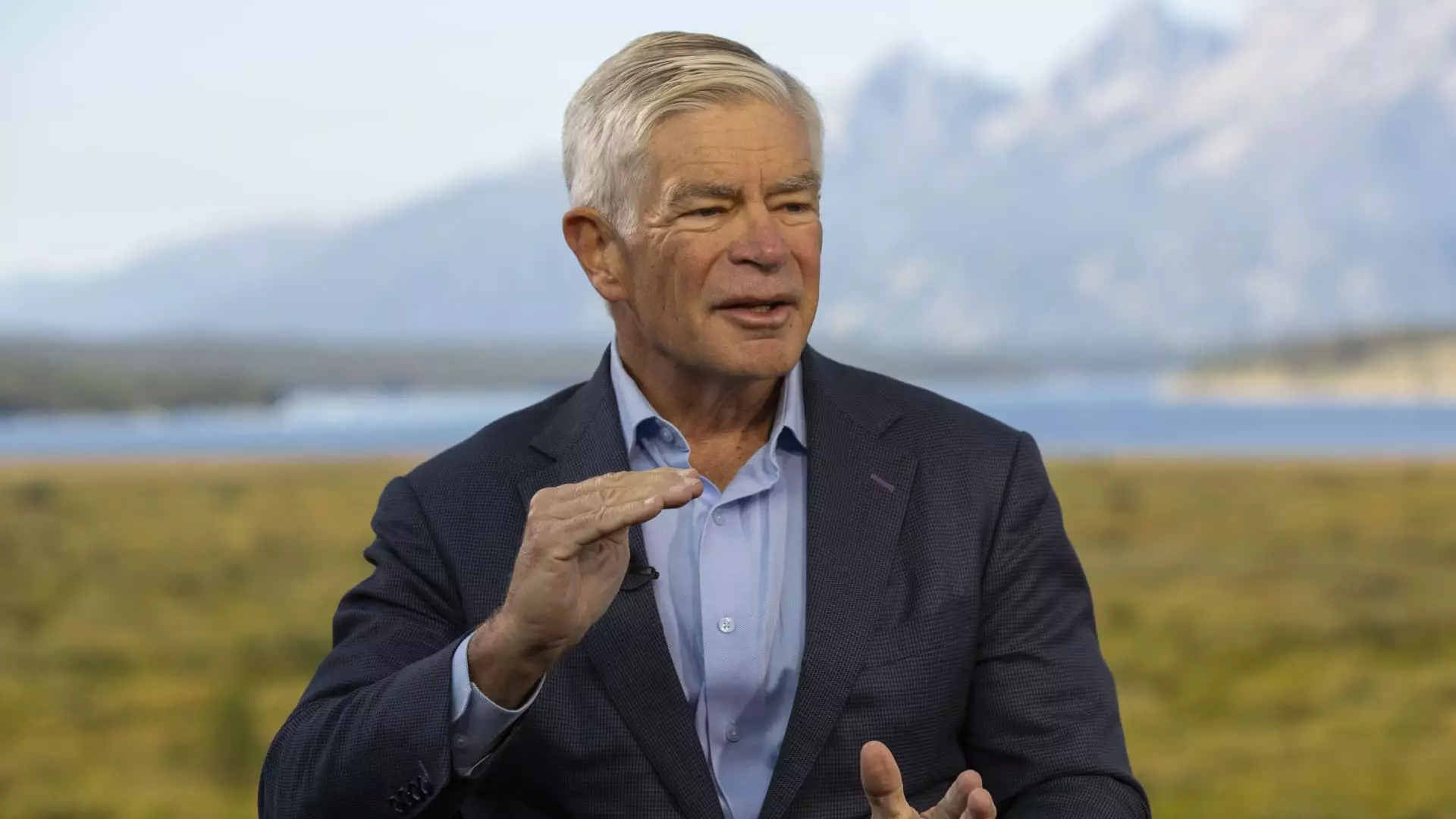

Kansas City Federal Reserve President Jeffrey Schmid also weighed in on the future of policy, indicating a leaning towards a rate cut. Schmid highlighted the impact of the rising unemployment rate on the economy, noting a shift in the labor market dynamics. While acknowledging the positive impact of cooling job indicators on inflation, Schmid emphasized the need for continued monitoring and assessment of the labor market situation.

Schmid expressed confidence in the resilience of banks under the current high-rate environment, dismissing concerns of monetary policy being “over-restrictive.” As the labor market undergoes changes and inflationary pressures evolve, Schmid underscored the importance of a balanced approach to monetary policy that supports economic growth while addressing inflation concerns.

Federal Reserve officials are closely monitoring economic indicators and signaling a potential interest rate cut in response to inflation and labor market challenges. The government’s commitment to data-driven decision-making and economic stability underscores its role as a key player in shaping the future of the US economy. As market expectations evolve and economic conditions change, the Fed remains vigilant in addressing emerging challenges and opportunities to sustain growth and financial stability.

Leave a Reply