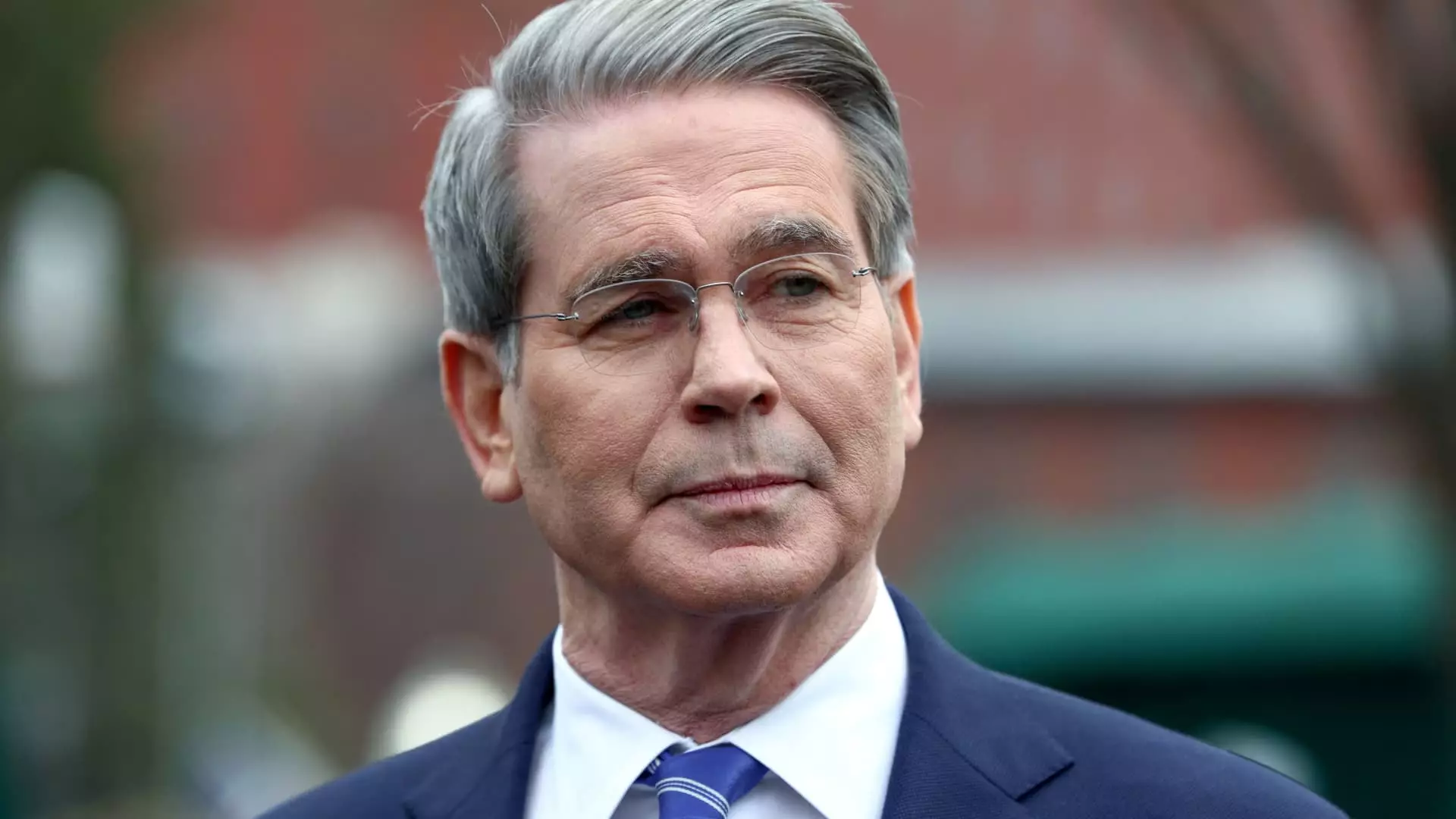

In recent discussions surrounding America’s economic landscape, optimism tends to overshadow a growing cloud of uncertainty. Treasury Secretary Scott Bessent’s remarks on NBC’s “Meet the Press” highlight this pervasive narrative, which confidently asserts that the Trump administration is nurturing long-lasting economic foundations. However, such an assertion begs critical examination, especially in light of the mounting evidence of an increasingly precarious financial climate. Bessent’s dismissal of American concerns regarding retirement security, especially in the context of a volatile stock market, is not merely an oversimplification; it’s a blatant misreading of public sentiment and fiscal reality.

When Bessent describes fears about retirement savings being a “false narrative,” he reveals a dangerous disconnection from the daily experiences of ordinary Americans. Retirement is not simply about long-term investments; for many, it is the culmination of years of hard work and prudent saving, often with the hope for a stable, peaceful future. This leans into a profound vulnerability that cannot be brushed off simply because market trends fluctuate. The stock market, while a critical element of wealth accumulation, is not the sole arbiter defining financial health. Many individuals live in the harsh reality of economic strain, where day-to-day realities compel them to confront their decisions head-on. The tendency to refer to day-to-day market fluctuations as irrelevant dismisses a mounting anxiety that runs throughout society.

Market Reactions: A Mirror of Economic Stability?

Bessent’s insistence that Americans generally maintain a long-term perspective on investments is grounded in a half-truth; yes, many do, but the urgency of looming financial concerns can compel even the most steadfast individuals to reevaluate their positions. The passage of time, combined with the recent plummet of major indices such as the Nasdaq and Dow Jones, raises alarms that cannot simply be swept aside as market overreactions. This week’s downturn serves as a critical juncture that underscores a broader, systemic struggle marked by layers of uncertainty, exacerbated further by the administration’s decisions.

The revelation that President Trump imposed considerable tariffs, soaring to 54% on key trading partners, hits at the heart of why such drastic measures may result in economic ramifications. Tariffs might seem like a temporary fix aimed at bringing back jobs and local investments, but they can often incite retaliatory measures, leading to a potential trade war that negates any short-term gains. The recent comments from Bessent and Trump calling for Americans to “hang tough” is enviably devoid of sympathy for those caught in the crossfire of speculative commerce. While these proclamations resonate with a sense of rugged individualism, they fail to address the structural imbalances at play, and more importantly, the human cost of such policies.

The Myth of Sustainable Economic Growth

One must ponder the assertion that the previous administration’s policies headed the nation toward financial calamity as conveyed by Bessent. While there may be valid critiques of past trade policies, it is disconcerting to think that merely shifting the responsibility can provide a sustainable solution. Instead, we should be interrogating the very foundations of our economic structure. The “unsustainable system” he referred to is not simply a byproduct of previous administrations but an outcome of decades of policy decisions that prioritize short-term gain over long-term stability.

The complexities of trade, globalization, and fiscal policies cannot be distilled into narratives of blame. By situating trade partners as exploitative players, we reinforce a dangerous dichotomy that neglects the interdependence inherent in global economics. Such rhetoric simplifies a multi-faceted issue and fails to appreciate the value of cooperative partnerships in fostering a healthier economy.

Bessent’s references to historical precedents, particularly that of President Reagan, appear out of touch with contemporary realities. While Reagan’s policies may have set certain fiscal pathways, the modern economic landscape is vastly different. An era marked by rapid technological advancements and shifting global dynamics requires a more nuanced approach rather than a “hold the course” mentality that risks deepening the chasm of disparity for many American households.

In this climate of uncertainty, one must recognize that the flawed narratives being peddled by figures in power reflect not only a misunderstanding of economic realities but a troubling absence of empathy toward the struggles of everyday Americans. Robust economic policy should seek to unify and uplift, rather than alienate and overlook.

Leave a Reply