Polymarket, a notable online election betting platform, is paving the way for its return to the United States following its successful prediction of President-elect Donald Trump’s victory. This move exemplifies a growing trend toward embracing prediction markets as legitimate platforms for political forecasting. Shayne Coplan, the founder and CEO of Polymarket, recently shared insights during his first live television interview on “Squawk Box,” attributing the company’s progress to those who have advocated for legalizing political prediction markets in the U.S. He expressed enthusiasm for future expansions, highlighting a commitment to bringing innovative betting solutions to the American public.

The platform has undergone significant changes since it ceased U.S. operations in 2022 after incurring a hefty $1.4 million penalty from the Commodity Futures Trading Commission (CFTC) due to failure to register. This hiatus has sparked discussions regarding the future of prediction markets in a heavily regulated environment. The CFTC’s stance, in conjunction with recent legal shifts, reveals a potential opening for platforms like Polymarket to operate once more within U.S. borders.

In October 2023, a significant legal ruling by the U.S. Appeals Court for the District of Columbia Circuit lifted a freeze on rival platform Kalshi’s election contracts, previously imposed by the CFTC. The outcome of this case signals a shifting landscape where political prediction markets might thrive. Judge Patricia Millett’s statement regarding the necessity of demonstrating irreparable harm for a stay underlines the evolving regulatory attitude that could empower these platforms.

With Kalshi breaking new ground, prominent trading institutions such as Interactive Brokers and Robinhood have also entered the arena, launching their own election contract products. Thomas Peterffy, the founder of Interactive Brokers, speculated on the future scope of these markets, predicting that political betting could outstrip the equities market in popularity over the next 15 years. This projection indicates not just a burgeoning interest but also hints at the potential for these markets to become a cornerstone of democratic engagement and public discourse.

One of the most compelling aspects of prediction markets is their inherent promise of accuracy driven by real financial stakes. Robinhood’s CEO, Vlad Tenev, emphasized during his remarks that the financial commitment individuals place on the outcome ennobles these markets as more reliable predictors than traditional polling methods. When people wager their hard-earned money, they tend to invest time and effort in analyzing the context, trends, and data surrounding the electoral landscape, leading to highly educated and biased decisions.

This dynamic embeds a layer of accountability within these markets, as participants are incentivized to ensure that their predictions are grounded in reality. Public figures like Elon Musk have also recognized the reliability of such platforms. Musk’s enthusiastic endorsement of Polymarket further amplifies the perception that betting is not merely speculative gambling; rather, it offers a nuanced echo of the electorate’s sentiments.

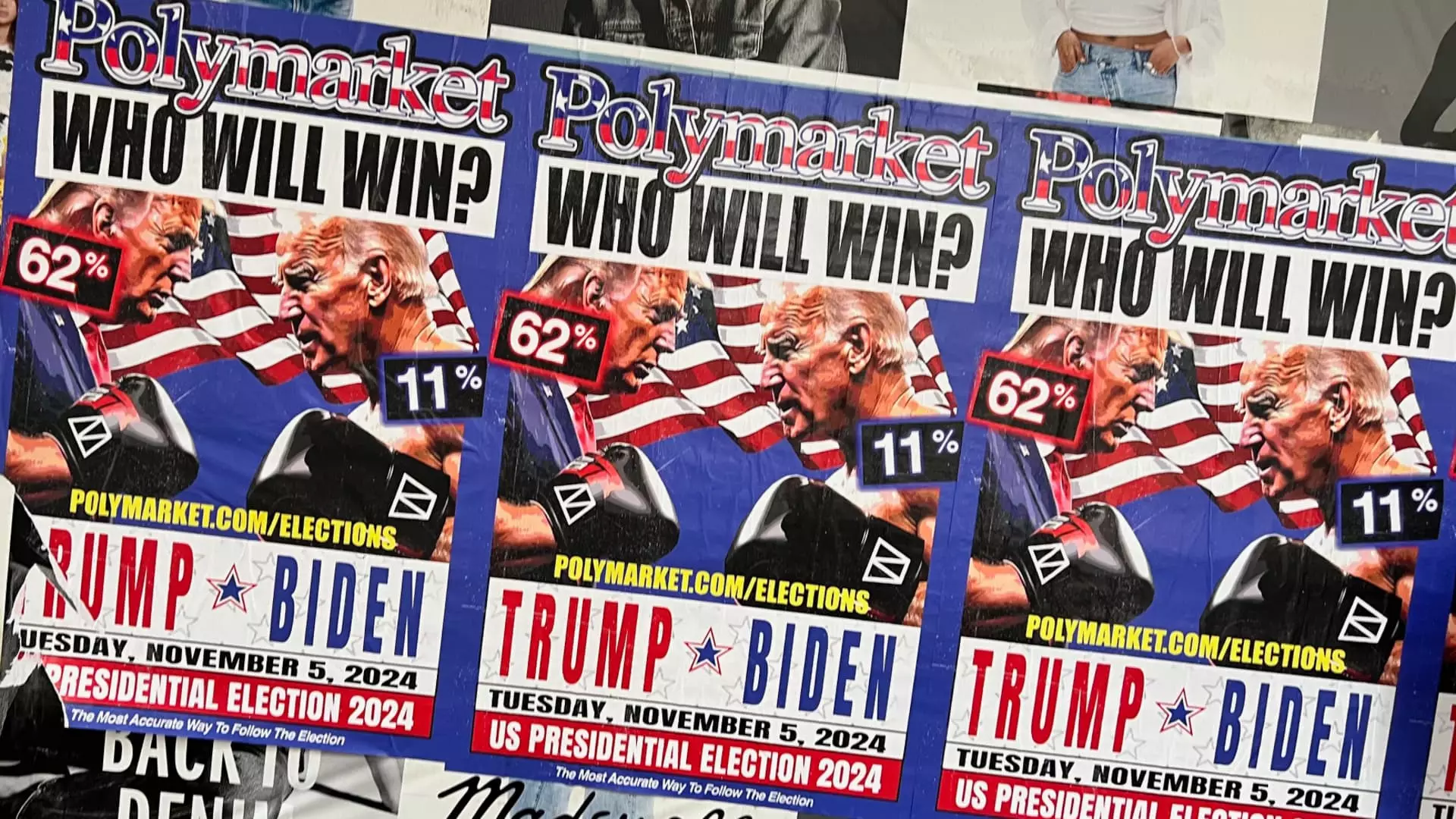

The recent surge in trading volumes on Polymarket—almost $3.7 billion for the presidential race—underlines the shifting dynamics of political engagement. Coplan noted how prediction market trends often diverge significantly from traditional electoral coverage. As election night unfolds, while mainstream media might indicate a tight race, Polymarket’s figures reflected a more decisive outcome in favor of Trump, providing an early indication of his electoral success.

Such disparities signal a potential shift in how elections could be viewed in the future, where prediction markets might serve as valuable tools for gauging public opinion. Utilizing concepts from the Overton window theory, Coplan posits that these markets can broaden the spectrum of acceptability in political discourse, thereby democratizing political forecasting and making it more accessible to the general populace.

The resurgence of platforms like Polymarket heralds an exciting era for political prediction markets within the United States. As regulatory landscapes evolve, the potential for these markets to integrate into the socio-political framework appears promising. This development could empower ordinary citizens not only to engage with but also to influence the outcome of electoral processes as active participants. The landscape of political betting is not only about financial gain but possibly revolutionizing the accuracy and methods of gauging public sentiment in contemporary politics.

Leave a Reply